Lippman Connects President Sam Lippman presents his annual 5 Data Points in 5 Minutes insights at this year’s Exhibition & Convention Executives Forum (ECEF).

The 22nd edition of ECEF, organized by Lippman Connects President Sam Lippman, was held this year on May 31 at Grand Hyatt in Washington, D.C. A signature feature of the one-day event is Lippman’s rapid-fire “5 Data Points in 5 Minutes,” research-backed insights about the current state and future direction of conventions and trade shows.

This year, Lippman started off with Q1 2023 Freeman research indicating the biggest drop in average age span of attendees ever recorded — from 51 to 46. “The future of our business depends on the next generation of event goers,” he said, around 22-44 year olds. “We need to make sure they understand and get value from our events because if they don’t come back, our exhibitors and sponsors won’t come back.”

The good news, he said, is that the research indicates that “conventions and exhibitions provide exactly what these folks need for their professional and career enhancement.” Those needs, in order of priority are: discovering new products, building their network, and expanding their business. Compared to pre-COVID times, Lippman said we are at 103 percent of attendance, because events are providing for their needs.

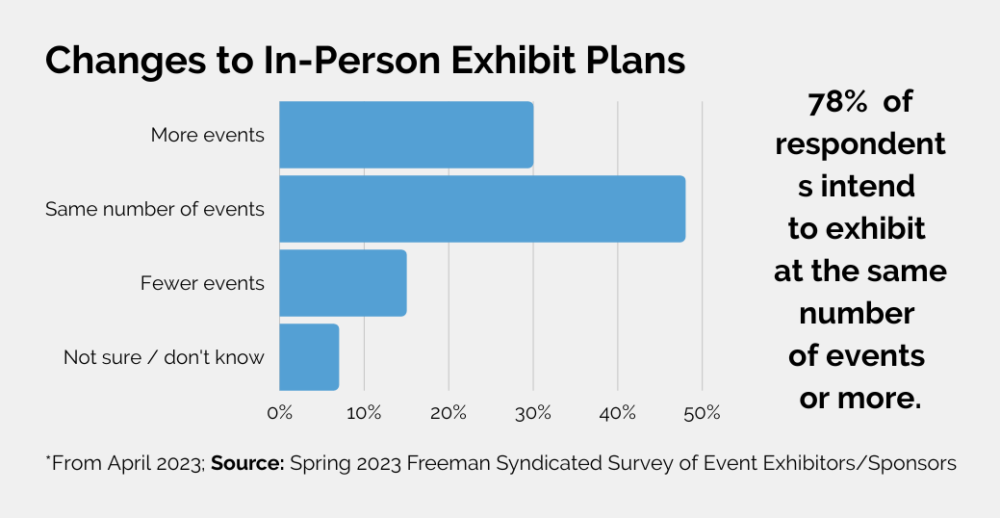

The second and remaining points were drawn from Freeman’s survey of 1,500-plus sponsors. The survey responses, Lippman said, show that “we’re in very good shape” — 78 percent plan to exhibit at the same number of events or more; 79 percent plan to maintain or increase their budget; and 89 percent plan to use the same or more space this year.

“Something else we learned that was a little bit of a surprise,” Lippman said, was the “amount of money exhibitors are spending with us remains the same as pre-COVID.” Nearly seven out of 10 respondents are purchasing sponsorships in the same number or more events, and more than four out of five plan to maintain or increase their budget.

Lippman said the third point was probably the most important: “We have a new audience,” including new exhibit managers — 64 percent of them are brand new. From pre-COVID to now, more event managers are women and more of them are younger. “This is maybe a once-in-a-lifetime opportunity,” he said, “to help a new audience of customers either fall in love with our events — or run away from them.”

New Exhibit Managers

By the Numbers

64% — New role since the pandemic

2 — Number of years younger than established exhibit managers

53% — Male

41% — Female

6% — Other

Lippman’s fourth point spotlights another high-potential opportunity: lead nurturing, which ranked lowest among the primary reasons to exhibit — only 7 percent of respondents identified it as a goal. Every company must recognize the number of high-value touchpoints that are required to turn a lead into a customer, Lippman said, and in-person events offer the best opportunity to build trust among prospects.

While the Freeman data cited at the beginning of Lippman’s presentation indicates that face-to-face events are meeting the needs of attendees, his fifth data point reflects an opposite reality for exhibitors. Events are not providing them with the value they are looking for, according to the survey. There are major gaps between what exhibitors say is important to them and how satisfied they are with how their participation at shows delivers on those goals. For example, 94 percent of exhibitors said meeting new customers is extremely important to them, but only half expressed satisfaction on meeting that goal.

“We have to work with our exhibitors, understand their objectives, and help deliver on those objectives,” Lippman said. There are competing ways to launch new products, he said. For example, making new product announcements at a trade show ranks only two percentage points higher than a post on social media. Another red flag for shows: More than half of respondents said they are considering hosting their own private events. “We have to make our events so strong that they will not leave for their own private events,” Lippman said.

And where those events are held is also key to exhibitor participation. Around half of the survey respondents said the location of the host city has a major impact on their decision whether to exhibit at the event. Noting that 46 percent said they are working with smaller marketing/sponsorship budgets with around the same percentage concerned about inflation, Lippman said, “We have to be vigilant” about costs, which means choosing the right locations “that are cost efficient to get there, to stay there, and to install their displays.”

Michelle Russell is editor in chief of Convene.