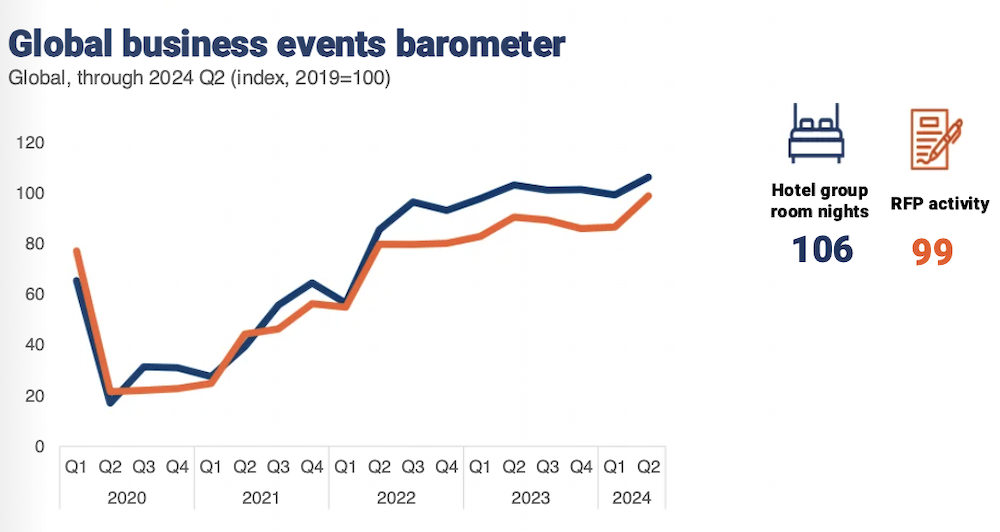

Source: Events Industry Council, Oxford Economics, STR, Amadeus’ Meeting Broker, Cvent

The Events Industry Council (EIC) Global Business Events Barometer, reporting on key metrics from this year’s second quarter, reflects an “exceptionally positive” forecast for the industry, EIC CEO Amy Calvert said in the report. The report relies on data inputs that have been provided by STR, a division of CoStar Group, which provides market data on the hotel industry; Cvent, a meetings, events, and hospitality technology provider; and Amadeus Hospitality and its MeetingBroker distribution platform.

“This report comes at a moment when we as a global society continue to grapple with many challenging issues, including the disruptive forces from climate change and related catastrophic weather events, geopolitical turbulence, war taking place on multiple fronts, the threat of continued escalation of tension between rival countries, and the related multiple humanitarian crises.”

Calvert underscored the industry’s “resilience” in the face of these significant challenges, and reinforced “the true purpose and impact of our industry as conduits for human connection and community building.”

Some key findings in the report that indicate continued improved industry performance:

- Global room rates in RFP responses in 2024 Q2 averaged 124 percent of 2019 levels, while the RFP activity index, representing bids sent by event planners during the quarter for future events, increased to 99 percent of 2019 levels.

- Hotel group demand gains were particularly strong in the Middle East and Western Europe. RFP activity gains were strongest in Africa and Latin America and the Caribbean.

- There was a slight uptick in longer event windows from the first quarter, with more hotel RFPs for events to be held 12-plus months into the future.

- RFP activity for small events improved to 97 percent of pre-pandemic levels, showing some of the improvement that has already been evident in large and medium-sized events (200-plus room nights on peak).

- The top perceived downside risk to businesses in the near term is geopolitical tensions, specifically related to the Middle East, China-Taiwan, and Russia-NATO.

Despite the risks and issues we are experiencing as a global society, as a sector, we in the business events industry, Calvert noted in the report, “are learning to adapt to the evolving expectations of our constituencies, and the ongoing challenges to support and build our workforce.”

Michelle Russell is editor in chief of Convene.

On the Web:

Download the full report, prepared by Oxford Economics, here.