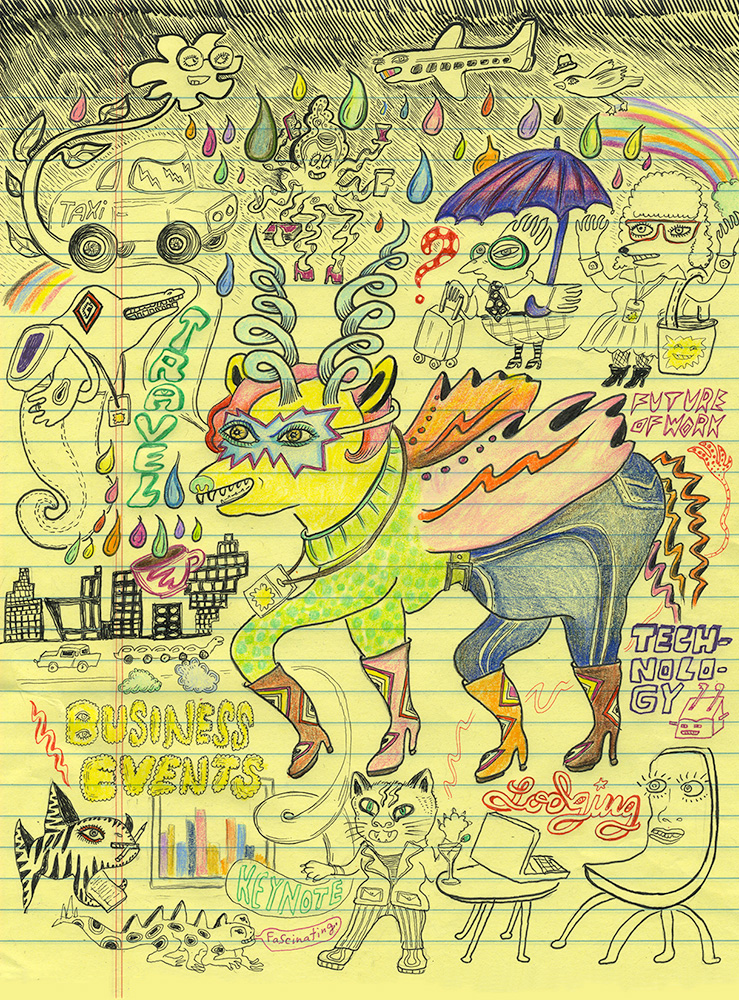

Illustration by Julie Murphy

Annual Events Industry Forecast

Our usual approach to Convene‘s Annual Industry Forecast is to cast a wide net, gathering a variety of data related to the business events industry, including travel, lodging, technology, and the workplace. This year, we took a different tack. Instead of those wide-ranging forecasts, Convene editors wrote succinct trends reports for each sector. We’ve sifted through the research to come up with a few signposts to help you navigate the year ahead, whatever course it takes. And, as always, the Forecast includes our Annual Meetings Market Survey, which gives us a strong sense of where we stand at this moment in time — the ups, the downs, the challenges, and our overall mood.

The business events industry can expect to see shifts in where we’re traveling to for meetings and events In 2025 and beyond.

Across many recent forecasts, the one consistent trend I see for 2025 is that the appetite for in-person gatherings will be stronger than ever. “Demand for groups, meetings, and events (M&E) has been extremely robust across the globe,” according to the CWT GBTA 2025 Global Business Travel Forecast. “There is still a pent-up need to connect with colleagues, customers, and business partners post-pandemic.”

GBTA’s research indicates that business travel spending will exceed 2019 levels in 2024 at $1.5 trillion, representing an increase of 11 percent over last year. Growth is expected to continue to gradually moderate, resulting in an annual compound growth rate of 7 percent from 2025 to 2028.

But due to many variables and shifts — from rising travel costs to road warriors prioritizing their physical and mental wellbeing post-COVID and weighing the environmental impact of their travel — we can expect to see some interesting changes in travel patterns ahead.

Data shows that business travelers are increasingly eschewing one-day business trips in favor of three- to five-day trips that feel “more thoughtful and productive,” said GBTA CEO Suzanne Neufang. This preference for a roomier window of time means we’ll likely see the continuation of another trend we already know and love: bleisure travel.

Similar Vibes

Next year and beyond will also bring shifts in where we’re traveling to for meetings and events. Namely, that planners will increasingly look to second- and third-tier destinations as alternatives in an effort to economize — while also balancing attendee expectations. According to the 14th Global Forecast from Amex GBT Meetings & Events, meeting professionals say that the host destination makes up one-quarter of the overall attendee experience.

This mirrors an ongoing trend — coined “destination dupes” — happening on the leisure side: swapping a traditionally popular travel destination for a less obvious and less expensive alternative, say, Montréal over Paris. And less crowded: Over the summer, thousands of locals turned up in several European tourism hotspots like Barcelona to protest tourists taking over their cities. New fees and taxes to counter overtourism are being introduced, but many doubt they can stymie the crowds — especially when forecasts estimate that visitor numbers will continue to rise in popular destinations in 2025.

As a result, the destination dupes trend will likely keep growing. While it may feel like a fresh idea to leisure travelers, event professionals have long taken advantage of the budget-friendly perks of meeting in lower-tier cities. CWT recommends that planners “seek out secondary cities for meetings and events that now have low demand,” adding this proviso: “Booking early is essential.”

Jennifer N. Dienst is senior editor at Convene.

When asked about their most recent business trip, the most common purpose of travel among all global business travelers is attending seminars/training followed by conventions/conferences.”

Destination to Watch

Dallas, Texas

Dallas made a first-time appearance on Amex’s 2025 forecast of the top five U.S. meeting destinations and took the No. 4 spot on Cvent’s list of top meeting destinations in North America. Cvent reports Dallas leads the country in hotel room pipeline (20,000), and the Kay Bailey Hutchison Convention Center is set to unveil a $3.7 billion expansion by 2028.