Convene asked business event industry professionals and suppliers to take our survey about the COVID-19 pandemic’s effect on the industry. In total, 1,776 people responded.

To get a sense of how the events industry is responding to the unprecedented business disruption caused by the coronavirus pandemic, PCMA sent out an email invitation on April 1 to its database of planner and supplier professionals to participate in a survey. The link to the survey was also included in PCMA newsletters and on social media. A total of 1,776 people responded to the survey over five days; 69 percent (1,230 individuals) identified as business event professionals; 31 percent (546) identified as suppliers serving business events professionals. The largest percentage of respondents work for DMOs (22 percent), and the majority of all respondents (56 percent) work in the sales and marketing role in a variety of sectors.

Here are highlights of suppliers’ responses:

Employment Effects

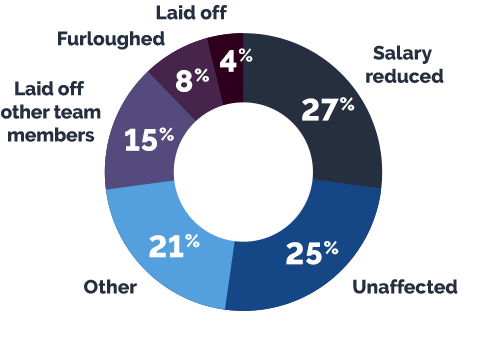

Twenty-five percent of respondents who work for an organization said their employment has been unaffected by the COVID-19 pandemic. But a greater percentage — 27 percent — said their salary has been reduced, 8 percent have been placed on furlough, and 15 percent have had to lay off other members of their team. Only 4 percent have themselves been laid off, but those results most certainly skew much lower than the reality. Since PCMA’s email database is comprised largely of business rather than personal addresses, those who have been furloughed or laid off would not likely have received the invitation to participate unless they responded via social media.

Q: If you work for an organization, how has your employment been affected by the COVID-19 pandemic?

Business Expectations

As hoteliers and CVBs reel from record-low occupancy rates, canceled conventions, and non-essential travel bans, some travel and tourism professionals nonetheless expressed optimism about the short-term. “I think in six months, we will be working again more than ever,” one respondent wrote. The vast majority of suppliers are looking at the next six months, however, as a period of uncertainty with the hope that the industry will slowly start a recovery phase in September.

Reskilling

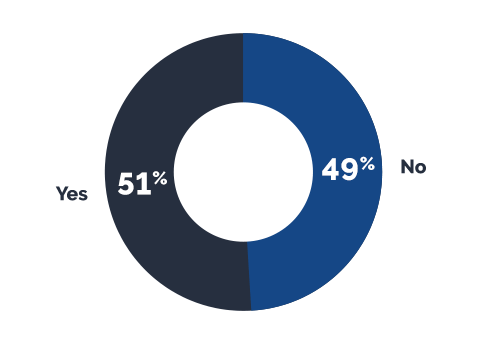

When asked if they considered or have started developing other skill sets during this time of uncertainty, suppliers were almost evenly split: 49 percent said no and 51 percent said yes. A number said they were learning new technology, brushing up on negotiation skills, and learning new jobs at their organization to cover for those who have been furloughed or laid off.

Q: Have you considered or have you started developing other skill sets as a result of this unprecedented business disruption?

What to Expect Next

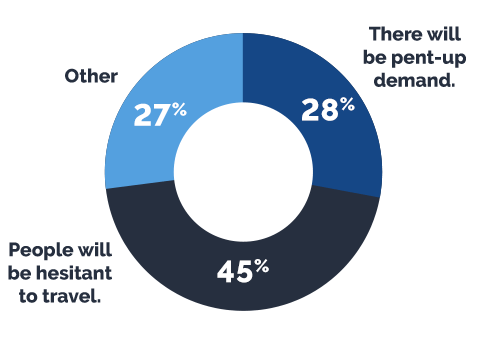

When asked how they foresee demand for face-to-face events over the next nine months, 45 percent of respondents said that they think people will be hesitant to travel; 28 percent anticipate that there will be a pent-up demand to meet. “There will be pent-up demand and professionals will know that they need to get back to F2F meetings for the sake of the economy,” said one respondent, “but I feel like it’ll take 12-18 months before attendance gets back to similar 2019 levels. Said another: “I agree to pent-up demand but we feel meetings will look different — they will be smaller over the next nine months. We think 2021 will be business as usual.”

RELATED

- Top-line results from the survey of planners

- Full results of the survey will be published shortly at pcma.org.