The next generation of event attendees is bringing demographic changes and dramatic shifts in values compared to previous generations.

Last month, for the first time, the number of Gen Z workers overtook Boomers in the U.S. workforce. Although the margin is small — there are 300,000 more Gen Z workers than Boomers in a full-time workforce of 127 million — it’s a trend that is accelerating rapidly, Ken Holsinger, Freeman’s senior vice president, strategy and research, told Convene. By 2030, three-quarters of meeting attendees will be categorized as Millennials and Gen Z, he said.

“The big story we’ve been following is the conversation around the next generation,” he said, which is bringing not just demographic changes to the events landscape, but dramatic shifts in values compared to previous generations. To answer questions about how well event organizers are — or aren’t— adapting, the Freeman 2024 Organizer Trends Report, released this week by the global events company, compares the current preferences of event attendees and exhibitors with the perspectives of event organizers.

For the report, Freeman surveyed 453 event organizers on a range of topics, including how they ranked their challenges and priorities and how they think about their audiences and specific elements of their meetings. Freeman then compared event organizers’ responses with the company’s data about what event attendees and exhibitors most want and value at events — revealing significant gaps between the two in multiple areas. Many organizers, the report said, “are operating with outdated definitions of attendee and exhibitor value.”

Part of the disconnect is the fact that the industry has been planning events for Boomers for the last 30 to 40 years, Holsinger said. “We know that we need to reach all of the generations that are in our meetings, but we need to recognize that as Boomers rapidly retire and as [the smaller] Gen X [generation] begins to retire, we need to think differently.” For example, Boomers rank “experiences over possessions” and “environmental/social responsibility” as low-priority values; Gen Z rank them as very high, according to the report.

Part of the disconnect is the fact that the industry has been planning events for Boomers for the last 30 to 40 years, Holsinger said. “We know that we need to reach all of the generations that are in our meetings, but we need to recognize that as Boomers rapidly retire and as [the smaller] Gen X [generation] begins to retire, we need to think differently.” For example, Boomers rank “experiences over possessions” and “environmental/social responsibility” as low-priority values; Gen Z rank them as very high, according to the report.

Ken Holsinger

Freeman discovered a model for different approaches within their data, he said. In their analysis of event organizers’ responses, a subset emerged: a group of event organizers who think and operate differently than their peers. This group — a little more than one-quarter of all respondents (27 percent) — “really ran the spectrum, from corporate event planners through health care, and traditional trade shows, meetings, and conferences — the full gamut of the business events spectrum,” Holsinger said. “And by and large, across the whole report, they thought differently, acted differently, and responded differently” to challenges.

Here are some key ways that the group, dubbed “the Innovators” in the report, do things differently:

Innovators’ events evolve constantly. When asked to what extent their organizations evolved event programs from one event to the next, 35 percent of event organizers said that their events followed established patterns or that their organizations are resistant to change. In contrast, Innovators reported that they made changes in each event cycle, in response to changing audience and market needs. “I think this is really critical,” Holsinger said. The Innovators, like other respondents, feel pressures, including that of providing more value amid rising costs, yet “somehow the Innovators are pulling through and saying they are moving forward.”

Innovators feel more empowered to make changes. Nearly half — 47 percent of planners — said that they were “not at all” or “only somewhat” empowered to make changes to evolve their events, and 23 percent said they felt “very” empowered to do so. Of the 30 percent of respondents who said that they felt “extremely” empowered to evolve their events, a majority — 58 percent — were Innovators.

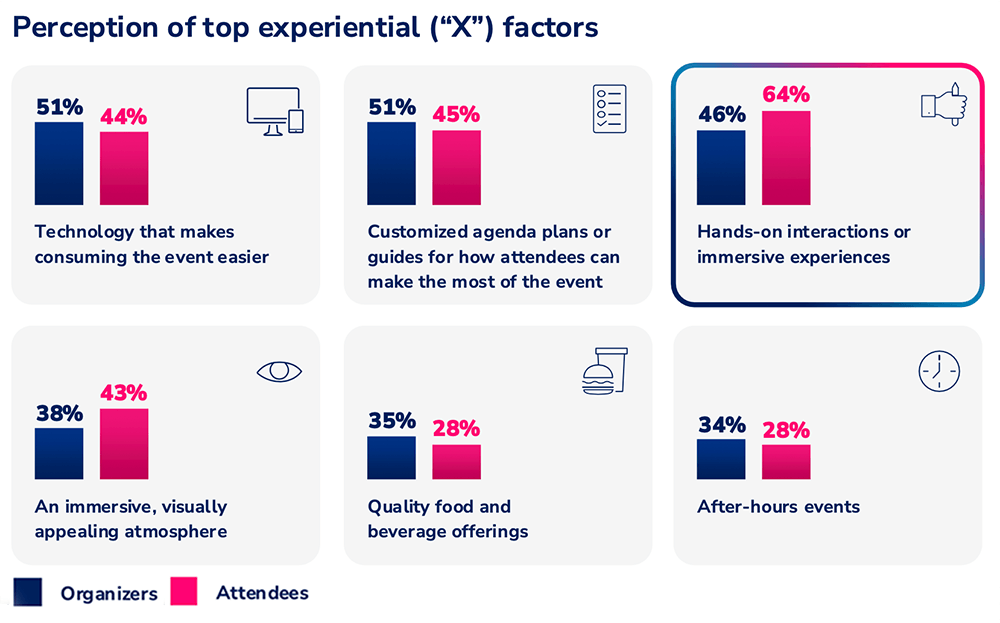

Innovators are more likely to change up their educational formats. There is a big disconnect between planner perceptions and attendee expectations around learning (see graphic below). Attendees want collaborative learning experiences, like hands-on interactions, demonstrations, and informal meetings with subject matter experts, yet 65 percent of organizers rated traditional classroom sessions as the top learning experience. Although there is a time and place for lectures, according to the report, “attendees are telling us that the on-site event isn’t it.”

Innovators focus more on attendee experience than on attendee numbers. Nearly half — 46 percent — of all event organizers ranked increasing the number of their attendees/attendee revenue as their top goal, followed by elevating the attendee experience (42 percent). Innovators reversed that order, with 40 percent choosing to focus on attendee experience as their top goal, followed by increasing the number of their attendees/attendee revenue (38 percent).

Innovators focus more on attendee experience than on attendee numbers. Nearly half — 46 percent — of all event organizers ranked increasing the number of their attendees/attendee revenue as their top goal, followed by elevating the attendee experience (42 percent). Innovators reversed that order, with 40 percent choosing to focus on attendee experience as their top goal, followed by increasing the number of their attendees/attendee revenue (38 percent).

Innovators are more likely to see private events as a threat. The report notes that more exhibitors are considering (43 percent) or already planning (19 percent) their own events — but only 21 percent of conventional planners see private events as a risk, compared to 38 percent of Innovators. “Given how in tune [Innovators] are with their event ecosystem,” the report states, “we think this is an insight worth noting.”

Innovators pay attention to who isn’t at their events. Innovators aren’t just talking to the same group of people who have been attending their events, “they’re stepping out and asking: Who isn’t attending and how do we reach them?” Holsinger said. Innovators are more than twice as likely to say they want to focus attention on the people who have never been to their events than more conventional event organizers, he said. “If we just keep with the same post-event survey work and net promoter score methodology, we’re just going to end up with the same audiences.” And ultimately, he added, “as we see Gen X and Boomers leaving the workforce, if the traditional planners don’t shift their mindset to net new [attendees], we’re going to rapidly see over the next five years a number of events really struggle with staying relevant.”

Barbara Palmer is deputy editor of Convene.