Sam Lippman shares his five event trends in five minutes during the Nov. 3 Exhibition & Convention Executives Forum at the Hyatt Regency Hotel in Arlington, Virginia. (Chris Ferenzi Photography)

While the 20th edition of the Exhibition & Convention Executives Forum (ECEF), held Nov. 3 at the Hyatt Regency Hotel in Arlington, Virginia, looked very different than previous versions, it was kicked off with a rapid-fire session that has been a mainstay of the event over the years: Organizer Sam Lippman starts the clock and challenges himself to share five industry trends in five minutes.

In response to COVID-19, the 2021 event’s floorplan was designed to enable social distancing, and a new format allowed for more networking and one-hour blocks of programming. And, of course, the pandemic played a central role in the trends Lippman presented, which he attributed to Ken Holsinger, senior vice president of strategy, data solutions, for Freeman.

First up, a data point that will come as no surprise to event organizers: Delta affected attendee confidence. In July, before the delta variant started causing COVID cases to spike, according to Freeman Event Research, confidence in attending in-person events was at 86 percent; by October, it had gone down to 65 percent. The average attendance in the last 90 days, Lippman said, is about half of what it was in 2019.

RELATED: ECEF Introduces Automated Contact Tracing

The second data point: Attention spans are dropping. The average time spent at virtual events in April was 5.6 hours; by October it had fallen to 4.2 hours. This is an important metric not only for virtual events, Lippman pointed out, but for physical events as well — it’s an important consideration when planning session lengths for events in both realms.

Shorter also is the name of the game when it comes to event duration: Attendees want shorter events. A three-day program is their preference, and for event organizers seeking optimal attendance, they should plan for their event to run mid-week — Tuesday, Wednesday, and Thursday are the preferred days. Lippman said that the pandemic has caused people to reevaluate their priorities and they are less willing to have business travel cut into their weekends and free time.

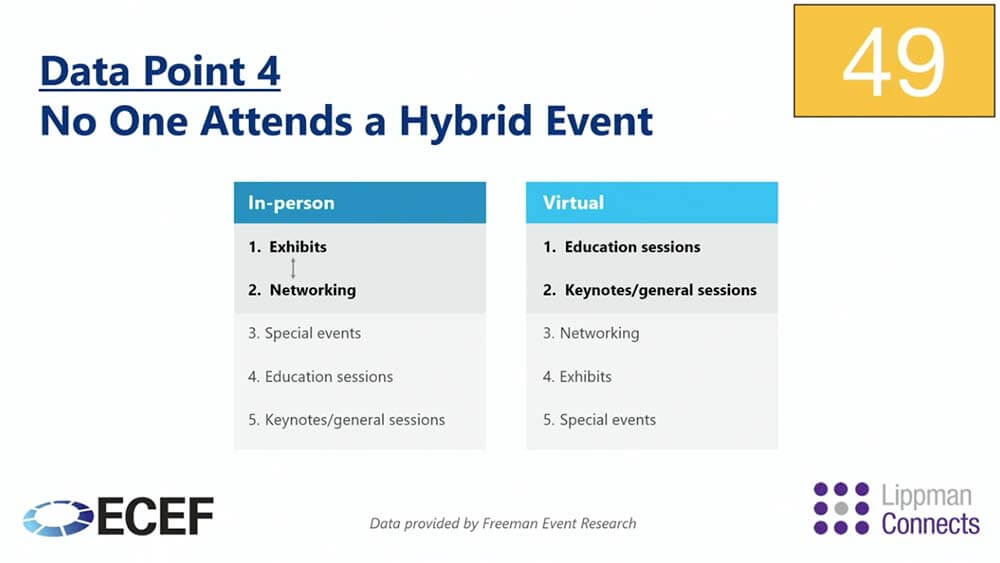

No one attends a hybrid event is data point 4. We have to think of the in-person and digital experience as two separate events accomplishing different goals, Lippman said. The main two objectives for attendees at in-person conventions are visiting exhibits and networking, followed by attending special events — education sessions and keynotes/general sessions are at the end of the list. For the virtual audience, those priorities are flipped: Education sessions and keynotes/general sessions top their reasons to attend, followed by networking, exhibits, and special events.

No one attends a hybrid event is data point 4. We have to think of the in-person and digital experience as two separate events accomplishing different goals, Lippman said. The main two objectives for attendees at in-person conventions are visiting exhibits and networking, followed by attending special events — education sessions and keynotes/general sessions are at the end of the list. For the virtual audience, those priorities are flipped: Education sessions and keynotes/general sessions top their reasons to attend, followed by networking, exhibits, and special events.

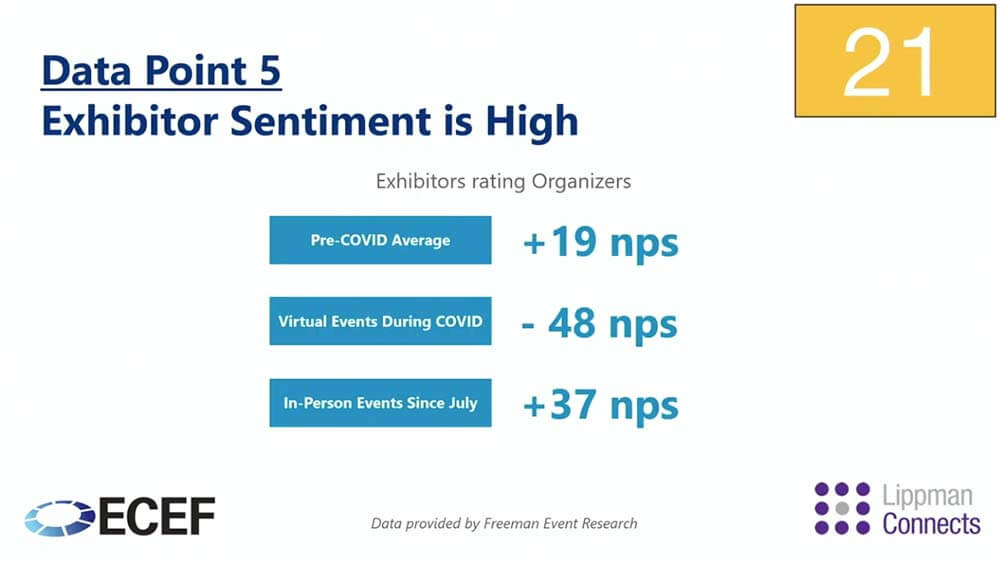

Lippman ended his trends report on a high note (and on time). The last data point: exhibitor sentiment is high. The pre-COVID average NPS — net promoter score index measuring the willingness of exhibitors to recommend an event to others — was +19. As we learned during virtual-only events with an exhibition component during 2020, it’s more challenging to provide exhibitor ROI — the NPS score among exhibitors for virtual events during COVID was -48. Exhibitors give in-person events since July an NPS score of +37.

Lippman ended his trends report on a high note (and on time). The last data point: exhibitor sentiment is high. The pre-COVID average NPS — net promoter score index measuring the willingness of exhibitors to recommend an event to others — was +19. As we learned during virtual-only events with an exhibition component during 2020, it’s more challenging to provide exhibitor ROI — the NPS score among exhibitors for virtual events during COVID was -48. Exhibitors give in-person events since July an NPS score of +37.

“The good news is exhibitors are really happy right now,” Lippman said. “They’re happy to see their customers in person, they’re happy to see their prospects — but this state of grace will not last. If we don’t bring [in] more attendees, if we don’t give [them] the events and days that they want, and if we don’t give them networking opportunities that are productive, they will not come back in 2023.”

Michelle Russell is editor in chief of Convene.