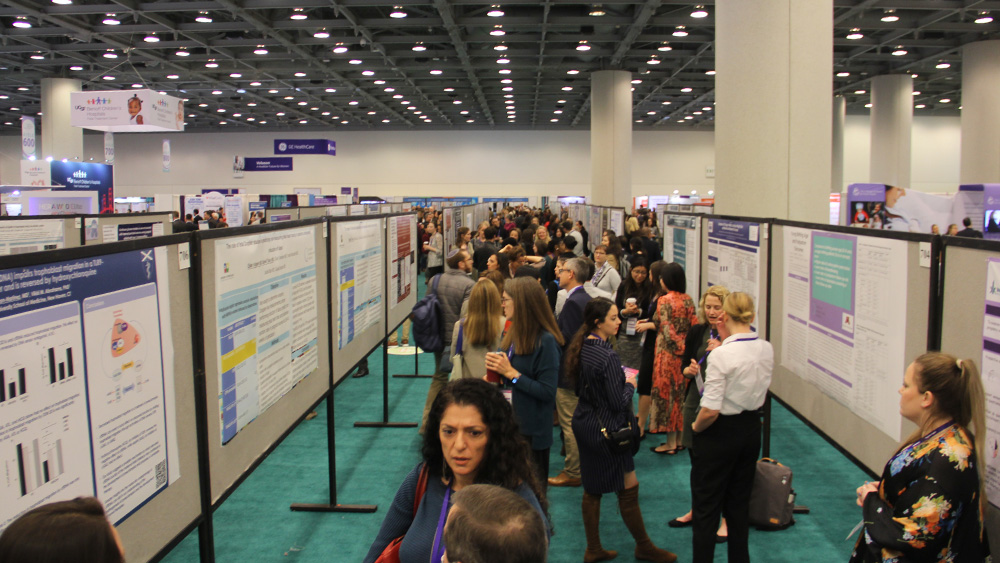

The Society for Maternal-Fetal Medicine (SMFM) held its 43rd Annual Pregnancy Meeting, Feb. 6-11, at Moscone West.

In March, urologist Ashley Winter took to X (formerly Twitter) to share that she wouldn’t be attending the American Urological Association’s 2024 annual meeting, May 3 – 6, 2024 in San Antonio, Texas.

“My husband & I are trying for our 2nd child. At 39 yrs old I have a high risk of miscarriage & I don’t want to go somewhere my healthcare options are limited should I have an emergency,” she posted. “I am saying this out loud because there are a lot of people in a similar situation to me who do not have the platform or comfort to say such things. I hope professional organizations bear this in mind when they choose conference venues.”

By mid-April, her post had received 1.1 million views, 23,000 likes, 2,400 reposts, and 404 responses, many of which came from other women and physicians voicing support for her decision.

That wave of dissent has become increasingly familiar for health-care associations that host meetings in states like Florida and Texas, where laws have placed extreme restrictions on abortion care and reproductive rights. According to The New York Times, 21 states currently ban or restrict abortion earlier in pregnancy than what Roe v. Wade established, and that number is increasing. In April 2024, Arizona’s Supreme Court upheld an abortion law written in 1864 — a ruling that, if stands, would eliminate abortion care almost entirely in that state. At press time, a lower court was hearing further arguments on the law, which bans abortion from the time of conception, with saving the life of the mother as the lone exception.

In a story in Convene’s January/February 2024 issue, we spoke with event professionals choosing not to cancel their meetings scheduled to be held in destinations that pass controversial laws (see On The Web). Their decisions were rooted in the belief that it’s important to demonstrate support for their members as well as affected communities in those destinations.

SMFM’s Pregnancy Meeting is the largest scientific gathering in the field of maternal-fetal medicine.

Making a Difficult Call

Moving their meeting to another destination, however, is the better option for some groups. That was the case for the Society for Maternal-Fetal Medicine (SMFM), whose 43rd Annual Pregnancy Meeting last year — originally scheduled to meet at the Gaylord Texan Resort & Convention Center in Grapevine, Texas — to San Francisco, Feb. 6-11.

Like many associations, SMFM signs contracts with its host destinations years in advance. In 2019, they began including a frustration of purpose clause when “we started seeing these really egregious state laws,” said Nneka St. Gerard, CMP, chief program officer, meetings, membership, and marketing at SMFM. That clause allowed SMFM to exit a contract up to two years prior to the meeting date if the state passed a law banning abortion pre-viability. At the time, St. Gerard said, that wasn’t something they worried too much about due to the protections afforded by Roe vs. Wade.

That all changed in 2021. That year, Texas passed SB8, which banned abortions starting at five weeks. The law also circumvents Roe vs. Wade by relying on enforcement by private individuals through civil lawsuits, rather than state officials enforcing the law with criminal or civil penalties. By then, SMFM was less than two years out from its annual meeting in Grapevine.

“We had what we thought were guardrails,” St. Gerard said. “But in this Texas instance, we fell outside of the frustration of purpose clause, so we had to bring it back to the board and say, ‘Okay, what are we going to do?’”

The financial penalty for canceling was steep — almost half a million dollars. And not everyone agreed on whether they should stay or go, St. Gerard said. Some members from Texas voiced an objection, saying that they would feel abandoned, and part of the board felt they could make more of an impact by staying in Texas. On the other hand, she said, “core to our mission is reproductive access.”

SMFM members are high-risk obstetricians, and abortion training is often part of the meeting’s educational curriculum. With SB8 allowing for prosecution of physicians who perform abortions, staying in Grapevine would mean risking the livelihood and safety of SMFM attendees.

“We were basically left with the decision,” St. Gerard said: “Do we completely alter the meeting and abandon talking about reproductive access? How could we ensure that our members, abortion providers, would be kept safe? Or do we move it and continue to support members with advocacy efforts in those states but not bring our meeting there?”

Ultimately, they made the decision to relocate the meeting to San Francisco when space opened up at Moscone Center. St. Gerard was able to negotiate the cancellation penalty down to almost half, thanks to the association’s positive, longstanding relationship with Gaylord Hotels and by contracting future meetings with the brand. But the tough call initiated a series of difficult conversations within SMFM about how, and where, they should contract their future meetings.

“We were basically left with the decision: Do we completely alter the meeting and abandon talking about reproductive access?” — Nneka St. Gerard, CMP, chief program officer, meetings, membership, and marketing at SMFM.

Fraught With Frustration

Now that Roe vs. Wade has been overturned, having foresight into where there is potential for this kind of legislation to pass is now top of mind for St. Gerard, as her shortlist of states where SMFM can consider holding its annual meeting has been whittled down to about a dozen. And when she factors in space and room requirements, “we’re left with a very small set of facilities and states that we can go to.”

Further complicating things for St. Gerard and SMFM is the number of venues that will reject their contracts solely because they contain a frustration of purpose clause, which prompted them to consider if it always makes sense to include one. SMFM is currently drafting a policy that allows St. Gerard to more nimbly navigate this and other questions when they arise. As for future meetings, SMFM has decided it will not host its annual meeting in states that restrict abortion. However, that will not apply to their smaller regional meetings. Said St. Gerard, “that’s where we can bring the message directly to the members in those states.”

Learning Opportunity

SMFM’s Nneka St. Gerard’s advice for event professionals facing similar challenges is to stay on top of the issues important to them. “It’s really about becoming educated about what the laws are in these states,” she said. “And partnering with your advocacy team to monitor all of it so that you know what’s coming and you’re not kind of surprised — [that] it’s not members that are telling us, ‘Can you believe what’s happening?’ [and that] we know, and we usually have a response ready. We’ve already started calling a meeting of the board to discuss it so that we can decide what our next steps are.

“We have to stay on top of it. And again, that’s not a role that I’ve ever had to play, but it’s kind of been my world for the past three years.”

Jennifer N. Dienst is senior editor of Convene.

On the Web

Read a Convene story about organizations that choose to meet in destinations with controversial policies at convn.org/no-boycotting.